Expert Medical Research Recruiting

The medical industry has seen enormous growth and change over the past two decades and market research has grown and evolved accordingly. Predicted continued growth means that recruiting research respondents will continue to be a critical part of obtaining quality medical market research insights. From this demand, a highly specialized niche has emerged.

Successful medical market research recruiting requires in-depth knowledge of the medical industry, sensitivity to security, privacy and knowledge of privacy laws, along with a willingness to employ multiple approaches to secure quality respondents.

Medical studies cover a wide range of topics from pharmaceutical testing to medical device trials. Studies seek to understand changing attitudes around healthcare, changes in access to medical professionals, usability testing, patient input studies and more. To effectively recruit for so many different research needs, teams of market research experts need to establish trust and rapport with potential respondents that includes both consumers and medical professionals. Extensive databases are just the beginning for what is needed to identify and effectively recruit the right respondent for medical research project success.

Rather have the PDF?

Chapter 1: A Growing Industry

The Medical Industry is Growing

The medical industry is booming across a wide range of verticals. While big pharmaceutical companies have become more dependent on mergers and acquisitions to fuel R&D needs, the landscape for growth in the global medical devices market is projected to reach $612.7 billion by 2025.

Experts predict that healthcare spending will increase 5.5 percent annually until 2027. In 2018, Americans spent $3.65 trillion, according to a report from Axios, averaging over $11,000 per person. With all this money being spent on healthcare, it’s no wonder that medical research marketing is an expanding industry. New companies consistently pop up, and long-sustaining industry leaders remain in the game, making the healthcare field an ever-changing and booming business.

According to Deliotte, global health care spending will continue to increase and create opportunity for overall sector growth. Beyond new drugs and medical devices, a rising geriatric population will also drive industry growth.

The Medical Industry Is Changing

A string of global healthcare crises such as AIDS, Zika, COVID-19, obesity and opioid addiction have highlighted a need for disease prevention and wellness outside the traditional healthcare system. Public, non-profit, and commercial enterprises are all involved in this shift. Understanding deeper social components to both disease, chronic conditions, and preventable outbreaks require increased insight about changing social norms, wellness trends and attitudes toward healthcare.

Municipalities and governments also continue to grapple with public policy shifts and the rising cost of healthcare. This, along with the continued growth in the medical device field, will keep the demand for medical market research in growth mode, and quality participant recruiting for medical market research studies in high demand.

Telemedicine

Technology continues to shift how consumers access medical professionals. For example, telemedicine (or telehealth) is able to connect patients to healthcare professionals quicker than ever before. Telemedicine allows health care professionals to evaluate, diagnose and treat patients in remote locations using telecommunications technology. It allows patients in remote locations to access medical expertise quickly, efficiently and without travel.

As consumer interest in user-friendly and more accessible healthcare grows, this new care model that is emerging, with the consumer more at the center, has placed more importance on gaining direct consumer feedback.

Telemedicine visits increased at an average compound annual growth rate of 52% per year from 2005 – 2014 (JAMA).

By 2025, telemedicine is projected to exceed $64.1 billion in the US, with the global market to surpass $130.5 billion. (Global Market Insights)

Chapter 2: Medical Market Research

Range of Studies

Medical market research happens across the span of the healthcare industry. There are few areas that are unexplored by research teams to gain insights about how people feel about their experiences. Here are just a few of the categories prevalent in the medical research industry:

- Pharmaceutical Trials

- Research and Development Iterative Feedback Loops

- Longitudinal Studies for Health Outcomes

- Brand Trackers

- Efficacy Projects

- Product Testing / Usability Studies

- Consumer Development

- Patient Experience (Voice of Patient)

Because of this wide range of research, multiple methodologies, both qualitative and quantitative, are needed across the industry to address specific research goals. While pharmaceutical drug trials may require participant recruitment with very specific requirements and a long-term commitment to a study with detailed instructions, a brand tracker may rely on a more generalized participant for a quantitative survey response. Focus groups may be required for one-off product testing, but a research and development study may require multiple feedback sessions from the same group of participants.

Shift in Marketing Target

A major shift in the medical industry in the last few decades has been the increase in direct to consumer marketing for everything from new drugs, to medical devices and even to health plans and private insurance products. In the past, pharmaceutical companies and device manufacturers were marketing directly to medical professionals. Now, the consumer is more often than not the primary target of marketing efforts. While medical professionals may introduce new products to their patients, consumers are driving requests for drugs, regimens or medical devices. Because of this shift in consumer behavior, companies now equally need feedback directly from the end-user as well as from medical professionals.

Beyond evaluating products and services, consumers are increasingly sensitive to brand reputation and customer service. Experts report that 80 percent of customers value the experience provided by a company just as much as they do its services or products. Marketing within the medical field has become more complex as companies build their brands increasingly in the general public’s eyes. Studies that go beyond product efficacy, but evaluate brand reputation and perception, need to carefully gather information about consumer sentiment for quality insights that can move a brand forward.

Because of this direct to consumer shift, hospitals, drug companies, healthcare device development companies and many other types of businesses in the medical periphery are looking for more feedback from the public. In these instances, the goals may include a large sample of respondents who are reasonably able to attend focus group meetings or personal interviews.

Chapter 3: Medical Market Research Recruiting Overview

Data Quality

As the need for medical research continues to grow, so does the need for qualified research participants. While researchers look to the data – the numbers from which to gain insight, the quality of the data is inextricably linked to the quality of people participating in the research. Properly sourced and well vetted research participants deliver the best quantitative and qualitative data necessary to produce actionable insights.

Common medical market research studies look for insight about patient experience, product usability, outcomes from treatment protocols, discoveries around product use, or even user experience from web-based services or new technology. Some studies need a large pool of respondents for a portion of the study and then need to access some respondents from that same group for follow-up or deeper conversations or focus groups. Medical research for FDA testing or medical journal papers may require certain sample group sizes.

While an increase in technology is driving a need for a larger sample group for some studies, some medical research projects require participation from a very specific population. When looking for patients with low incidence conditions, the qualified respondent pool is lean. Even if in a preliminary phase of a study a general respondent is needed, the scope may narrow to an extremely niche group. For example, when looking for general usability of a medical device, a company may want to know if an average consumer can understand how to use the device per the instructions provided and with what degree of efficacy. But as research and development iterations proceed, the research participant pool may need to be slimmed down. At one point, companies may only want to hear from in-home healthcare professionals or specific people caring for someone with a very specific disease or condition. When this respondent field narrows, expert medical recruiters can quickly adapt screeners and manage logistics to deliver the right people to the right study in the right frame of mind.

Sourcing quality respondents for either quantitative or qualitative studies starts with properly maintained respondent databases. Recruiters with medical research experience know how to effectively use their resources to find these very specific participants by quickly expanding their reach beyond their databases and relying on carefully built networks within the medical community. A successful medical respondent recruiting team has networks that include specialists, health system directors, teaching hospitals, in-home medical professionals, leaders of related non-profits, support groups and more. Input from a myriad of professionals around the medical and wellness field reveal additional prospects for projects with very targeted goals.

Knowledge Base

The healthcare field is changing rapidly with new discoveries, drugs, legislation and treatment protocols. Successful medical research recruiting requires a base of industry knowledge to keep up with these changes. New abbreviations for medical lingo crop up frequently; medical professionals move from one opportunity to the next. Recruiters are most successful when they regularly read trade journals, medical reports, etc., looking for ways to reach out to support communities, and maintaining regular contact with medical professionals and caregivers.

Relationship Base

Highly qualified recruiters work for years to establish rapport with medical professionals, medical office and hospital staff members, support group leaders and members, caregivers and other staff members of healthcare facilities. Filling medical research studies with high-quality respondents requires more than sorting through a database and picking out a few names. A highly detailed database is the starting point from which a recruiter begins to cross reference potential candidates and may require input from medical professionals. Quality medical research recruiters know when to engage these relationships to source the best research participants. These inquiries must protect the privacy of patients while determining their ability and qualifications for a study.

Chapter 4: Challenges for Medical Market Research Recruiting

Expert medical research recruiting requires experience, detailed databases, networking skills and resourcefulness.

The most successful recruiting experts work hard to earn the trust of potential participants and medical professionals alike. Because recruiting for medical research can be incredibly nuanced, hiring a recruiting team with fieldwork experience can save time and money – helping you achieve quality outcomes and stay focused on the research. Consider these issues when evaluating a recruiting team for your next project:

Geographical Challenges

While the results of medical research can have national and even global ramifications, studies may start with very set limitations. Some projects start specifically in a confined locale and then grow into multi-market projects. Others may need one study with very few people but with a significant spread to represent the nation geographically. A research project also may want to pull from within an age group or generation within a specific region. Each of these potential recruiting needs requires having access to both a national and local database that is proactively maintained and keeps a record of past study participation.

Ever-Changing Respondent Data

Medical research often involves stringent criteria with many exclusions or combinations of factors. When researchers need respondents that fit narrowly focused criteria, recruiters often start with extensive medical databases. Keeping a database for medical research requires constant recruiting and proactive file maintenance. Beyond typical database care, a medical database requires detailed tracking of conditions, specialties, subspecialties, education level, number of years in practice, past research participation and more. Databases that can be used for efficient medical research recruiting can track detail for both patient and medical professional populations. Great recruiters go beyond databases to cast a wider net to connect with potential respondents, but starting with a solid database is essential to help gauge the time needed to move forward with particularly challenging studies.

Keeping Up with HIPAA and Other Security Protocols

HIPAA (Health Insurance Portability and Accountability Act of 1996) safeguards patients’ medical information and health history and provides for data security. HIPAA rules need to be followed from the beginning of any project from proper screener set up to the storage of recruiting data and database security. Regardless of the number of vendors employed to realize a research project, each is responsible for a faithful execution of HIPPA regulations beyond professional confidentiality and operational security protocols.

Blind Experiment Protocols

Specific needs, such as filling a blinded experiment, require additional skill to maintain the integrity of the study. Withholding certain elements of the research can be an integral part of eliminating experimental biases and should be communicated to all involved with the study and included in the participant recruiting protocol.

Dealing with Respondent Limitations

Another aspect of medical research recruiting that requires tact and skill lies in the handling of limitations. Some patients may have conditions which limit their mobility or require special services to participate in studies. Sensitivity when calling for confirmations is a great practice to eliminate no-shows. Empathetic recruiters know how to anticipate how certain conditions or diseases may create situations where the respondent is genuine in their desire to participate, but the condition creates unpredictability with their ability to manage chronic pain, depression or deal in any other way with changes in their health. Building trust with key respondents is required to show good faith in accommodating issues as they may arise. Showing empathy when recruiting can increase the quality of respondents willing to overcome the challenges of participation even when they are significant. When respondent limitations become a large obstacle for in-person interviews, online research can be an effective solution.

Navigating the Practice

It can be extremely helpful to connect with medical professionals to determine how challenging a goal or objective may be. Extensive relationships with medical professionals and medical offices can help point a recruiter in a previously unseen direction. Beyond knowledge of individual staff members, it is important to understand specific policies at certain institutions or hospital systems. Navigating the hierarchy of teaching hospitals, private practices, group practices or hospitals that may have policies keeping their doctors from participating in outside research is a key part to moving quickly to fill a study.

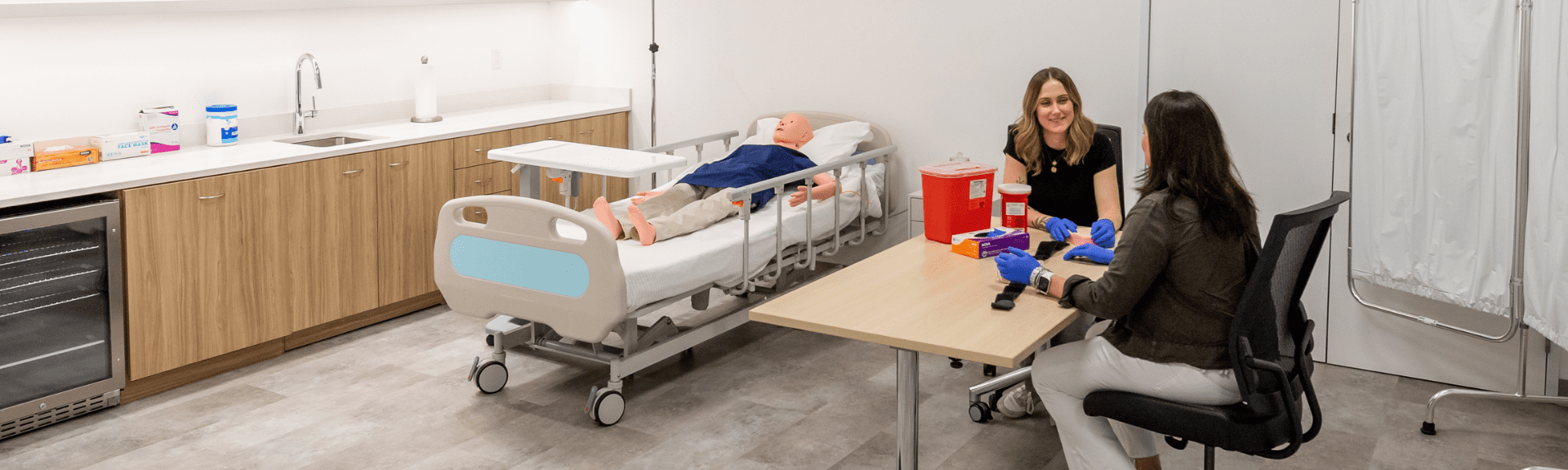

Experience an Optimal Medical Research Setting

Realistic Hospital Environment with Flexible Configurations

Our versatile setups replicate a lifelike hospital atmosphere, striking the perfect balance between comfort and practicality for medical research. Benefit from locking storage, easy refrigerator access, patient care manikins, adjustable hospital beds, mirrored one-way observation, and the guidance of our knowledgeable onsite staff.

Chapter 5: Best Practices for Medical Research Recruiting

While facing challenges from within and outside the medical industry, successful participant recruitment requires a system. However, the system itself cannot account for nuances needed to fill a study with the best participants possible. A recruiting firm well versed in the fieldwork needs of medical research professionals should be able to hold quality conversations around these issues:

Database

A carefully developed database will have a healthy mix of local and national populations. A database that has been properly maintained will not only cut down on time needed to find qualified participants, but it can be a significant part of the pre-screening process depending on the depth of detail maintained for each respondent. Working from a rich database from the beginning of the project can cut the lag time between the start and finish. While some vendors rely on legacy lists, and past research participants, great recruiting requires an updated list without gaps and a full account of previous research participation.

Methods

Digital resources have added a significant number of methods for increasing recruiting prospects. Social media alone has extended outreach and communication within medical communities and support networks and has increased the number of ways to identify qualified respondents. Regardless of whether the outreach takes place on social media, through online surveys, over the phone or in person, the methods should be in alignment with patient and client confidentiality. Protocols concerning patient outreach should be clearly communicated to the entire recruiting team with each new method of outreach established.

Connections

Great recruiters know how important it is to visit with professional medical staff and maintain a wide circle of connections within the medical industry. Visiting directly with consumers and patients and becoming active in events that are important to them gains exposure for the industry and builds trust with potential participants. Great recruiters are familiar with causes, awareness campaigns, walks, foundations and other activities important to patients, their caregivers and others in the field. Showing up physically to meet with organizers, educators, family members and others during these activities can make positive connections with patients and their support systems.

Knowledge

Continual learning should be a constant topic around medical research recruiting. Screeners and phone room personnel do not need to maintain deep knowledge across the medical field, but when recruiting for a specific condition, symptom or type of patient, they should be brought up to speed with general information and related medical jargon surrounding the issue before recruiting starts. Taking the time to gain a basic knowledge about the issue surrounding the recruit makes a difference in the immediate rapport building with potential participants and even can help with the initial internal screening of the database pool.

Respect

Most doctors, medical professionals and caregivers are strapped for time. In this fast-paced industry, respecting other people’s time is crucial to building and maintaining rapport for medical recruiting. Something as simple as providing clarity about length of time needed for a screener can

make an impression of respect for others. Likewise, calling back when expected shows a mindfulness about the time constraints others face in their job environment.

Sensitivity

Patients are also pressed for time; often they are pressed on quality of life issues. Patient participants are offered financial compensation for their time, but that may not always be the biggest motivating factor. They can also be compelled to help others based on the outcome of a trial or study. No matter why they are interested in participating in medical research, they still may be thwarted by health issues. Successful recruiters are sensitive to these challenges and should openly discuss possible physical accommodations to increase participation. In this way, empathy is a strong skill for any medical recruiting professional to develop and maintain.

Communication

Clients are provided with regular updates on recruiting benchmarks in any research recruitment project. Recruiting for medical studies requires a deeper level of communication as the screeners are typically more detailed and nuanced. When a project starts, a great recruiting team can provide feedback to the client from potential participants which can be helpful in steering the study to a better outcome. This quality of communication relies on the screeners and recruiting team being great listeners and asking better questions to yield the highest quality of respondents.

Creativity

Especially when looking for a very specific research participant, out of the box thinking can be helpful to cast a larger net. Recruiters who are confident in their traditional methods of outreach also are familiar with limitations. Allowing for new ideas and innovative approaches can result in finding a better way to source participants directly, or it may lead to approaching previously unreceptive organizations or hospital systems with a better proposition. Regardless of outcome, allowing for creativity within the confines of patient and client confidentiality is a best practice for medical research recruitment.

Representation

Keeping a big-picture focus on how medical research can improve the lives of patients, doctors and medical professionals alike can help keep a difficult recruiting project on track. The benefits of medical research, whether it leads to a medical breakthrough, improved access to healthcare or improved quality of life for patients, should remain top of mind. A successful medical research recruiter is in tune with a sense of ambassadorship. Tapping into a passion for improving peoples’ lives can help maintain focus even with a difficult study to fill.

Chapter 6: Finding an Expert Medical Recruiting Partner

Research projects are moving at a faster pace than ever before. Insights departments are being asked to do more with less and get it done quicker without sacrificing quality. A project cannot get into the field until the critical task of recruiting participants is completed. This places quality market research recruitment at a critical juncture of ensuring projects are completed well, on time and within budget. Finding an expert medical recruiting partner with extensive databases, years of experience, sensitivity to issues and knowledge of the medical industry can be a daunting task. Here is a list of questions to ask when vetting potential

partners for your next medical research study:

- What medical detail do you already know about those currently in your database?

- Do you have examples of low incidence medical condition recruiting success?

- What methods outside of proprietary databases do you employ to find potential medical research participants?

- How do your recruiters discuss potential disability accommodation with potential recruits?

- How experienced are the recruiters in your phone room with medical terminology?

- Will my project have a single point of contact?

- Do you offer a one-call solution for multi-location projects?

- What kind of experience does your team have recruiting surgeons, doctors or other specialists in the medical field?

- What kind of daily feedback is given to clients about recruiting progress and quota fulfillment?

- Do you offer a collaborative approach regarding challenges with the screener?

- With what kind of local and national medical groups does your recruiting office maintain relationships?

- How do you proactively build your databases?

In the end, industry expertise matters greatly but knowing specifically why certain partners excel in the medical marketing research recruiting field can lead to better project success. Knowing how a partner will focus on quick turnaround times, can adapt to methods, and maintain confidentiality can bring confidence in the data emerging from the research.

Recruiting qualified respondents can make or break your medical research study. They provide invaluable insights, and offer important intel, and actionable learnings. The medical industry continues to grow and change every day. New medications are introduced into the market, new discoveries are made about treatment efficacy, new major medical devices require user feedback. These initiatives require research. Keeping pace with the high demands of sourcing quality respondents for today and tomorrow’s medical breakthroughs is a demanding but rewarding job. When your project requires medical research recruiting expertise, and highly responsive communication, call the expert team at Fieldwork.

Focus on the research. We’ll do the rest.

Built to Support Your Important Research

Experience Fieldwork’s Medical Simulation Environments

End-to-End Market Research Support

Get the comprehensive support you need to conduct impactful research.